The COVID-19 pandemic has highlighted the importance of real-time digital payment infrastructures and digital financial services. It has also made clear the need for the digital economy to continue working irrespective of physical travel and pandemic limitations.

In the best of times, when countries aren’t experiencing extreme economic shock, closed-loop payments systems leave many underserved communities out of the formal financial system. In the worst of times, this structure leaves populations without a means of swift economic protection. Add this to new knowledge that by reducing person-to-person contact with cash, it’s possible to slow the virus’ spread; it’s clear that solving the challenge of interoperability and financial inclusion is as critical, if not more than it was prior to COVID-19.

In response to the economic and social consequences of COVID-19, more than one hundred countries have announced plans to scale up their systems to provide digital government-to-person (G2P) payments in order to provide relief quickly and transparently. And even more countries are making G2P payments a piece of their action plan. This has led many mobile money providers in Africa to lower or waive their fees as well.

These trends emphasize the growing necessity to bring affordable, inclusive digital financial services to a country’s entire population. Yet, work remains to achieve the interoperability-at-scale required to close the financial inclusion gap.

According to the World Bank, inclusive payment systems need to:

- Include vulnerable populations, such as those without access to technology, the elderly, people with disabilities, and those living in remote areas.

- Proactively address any barriers that result from transitioning to digital payments, such as ensuring critical services are not denied due to technical issues.

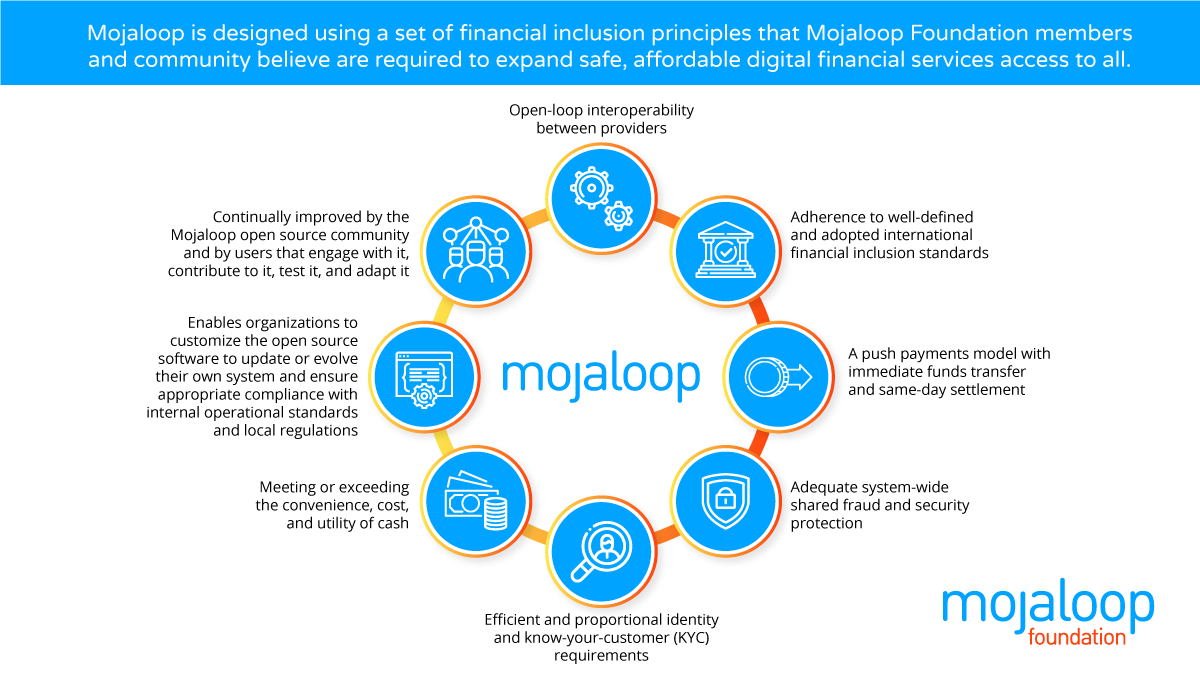

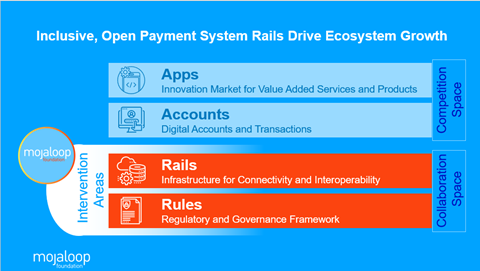

At the Mojaloop Foundation, we’re bringing together the philanthropic and technology leaders striving to realize the ideas for an inclusive payments system and beyond. Designed based on a set of financial inclusion principles, the Foundation’s open source software, Mojaloop, is a tool created for the public good. To help open markets and accelerate progress, Mojaloop is available to any nation or company within the digital financial service provider ecosystem. As a free public good, Mojaloop lowers upfront costs for designing interoperable payment models. It also provides implementers with a reference model of a commercially viable real-time, interoperable payments platform.

For more information on how Mojaloop ties into the larger initiative of financial inclusion, read our One Loop blog series on topics including Why Interoperable Payments Platforms Are Key to Financial Inclusion, Turning the Underserved into the Newly Served, Making Digital Financial Services More Affordable and Accessible, and How Digital Financial Services Benefit from Open Source.

Mojaloop is reliant on its community of supporters, contributors, evangelists, developers, and others to make our work possible and help achieve the Foundation’s mission of providing universal financial inclusion to all. Learn more about how you can get involved in the community and make an impact.

About the Author

Paula Hunter, Executive Director, Mojaloop Foundation

Paula Hunter manages the day-to-day affairs of the Mojaloop Foundation with responsibility for strategic planning and direction, membership development, budgeting, evangelism for the Foundation and its mission, and outreach to strategic partners.