Interoperability is necessary for financial inclusion, but it can be difficult to achieve. Today, in many countries, achieving full interoperability across various payment service providers and digital transactional platforms means bringing non-banks into the national payment system, including Mobile Network Operators (MNOs) that are authorized to provide payment services and digitally accessed transaction accounts. However, if each of those providers builds their payments platform separately, customers will be unable to conduct transactions across platforms, leaving many underserved.

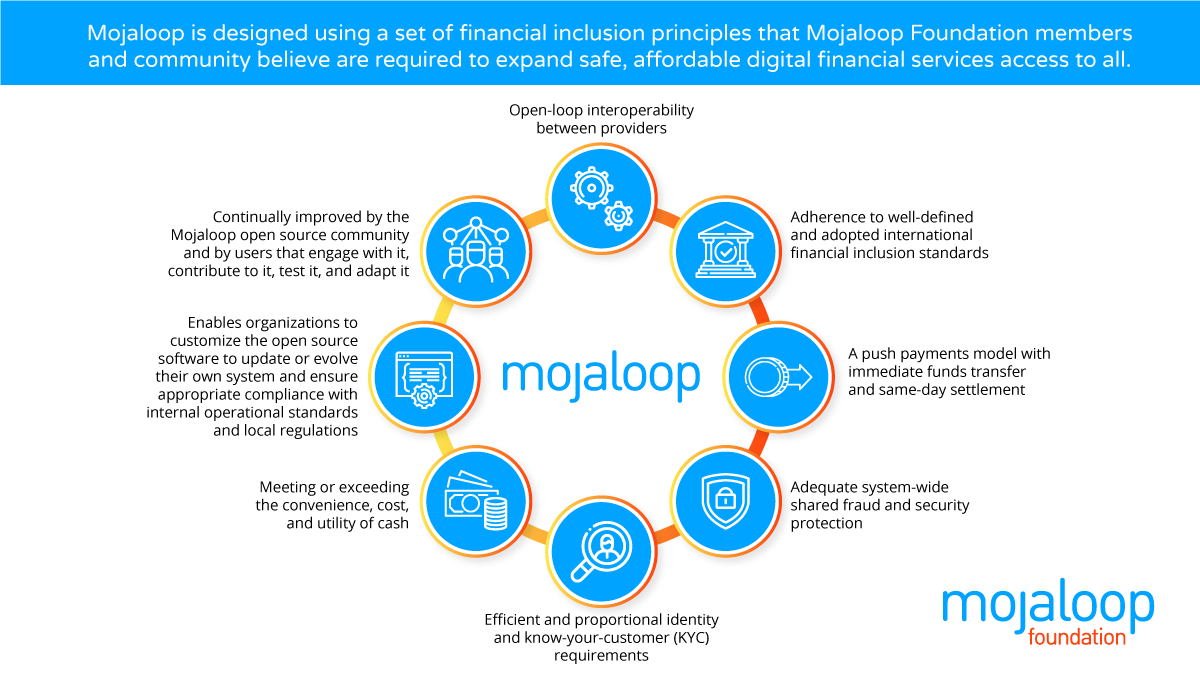

Mojaloop provides implementers with a reference model of a commercially viable real-time, interoperable payments platform. Plus, Mojaloop is designed using a set of financial inclusion principles that Mojaloop Foundation members and community believe are required to expand safe, affordable digital financial services access to all, including:

Mojaloop can be used whole, or adapted, to build digital payments platforms that connect all customers, merchants, banks, providers and government entities in a country’s economy, securely routing payments from anyone to anyone. Rather than a financial product or application that customers or institutions would interact with directly, Mojaloop is a layer that can connect all the financial products applications in use in any given market with the customers that need them.

All of our work is done using a collaborative, open source approach and anyone is welcomed into the community. If we want to achieve full financial inclusion, it is now necessary to accelerate the movement. Mojaloop and the Mojaloop Foundation enable this acceleration by providing a readily available, free-to-use blueprint that can be implemented much more rapidly than proprietary systems. Watch this space for additional information and feel free to contact us if you have any questions or wish to contribute to our organization.