Author: Kosta Peric, Deputy Director, Inclusive Financial Systems, Bill and Melinda Gates Foundation

At the recent Mojaloop Open Source Community Meeting in Nairobi, it struck me that the nature of the convening has changed over the years. What started as a gathering of a small bunch of tech geeks and enthusiasts is now a very different kind of event that was also attended by regulators, hub operators, central banks and FinTech companies. I think it’s a wonderful illustration of how Africa’s capabilities are maturing and how the demand for inclusive instant payment systems (IIPS) is growing.

Many years ago, Africa leapfrogged fixed telephone lines in favor of mobile telephony. Now we’re seeing that Africa is leapfrogging again to best-of-breed instant payment technology — even using advanced open-source software — without going through all the intermediary steps.

If you told me it would go this way a few years ago, I would have been very skeptical. But here we are with such a varied audience and discussions. The Mojaloop Community Meeting is truly an African event of importance now.

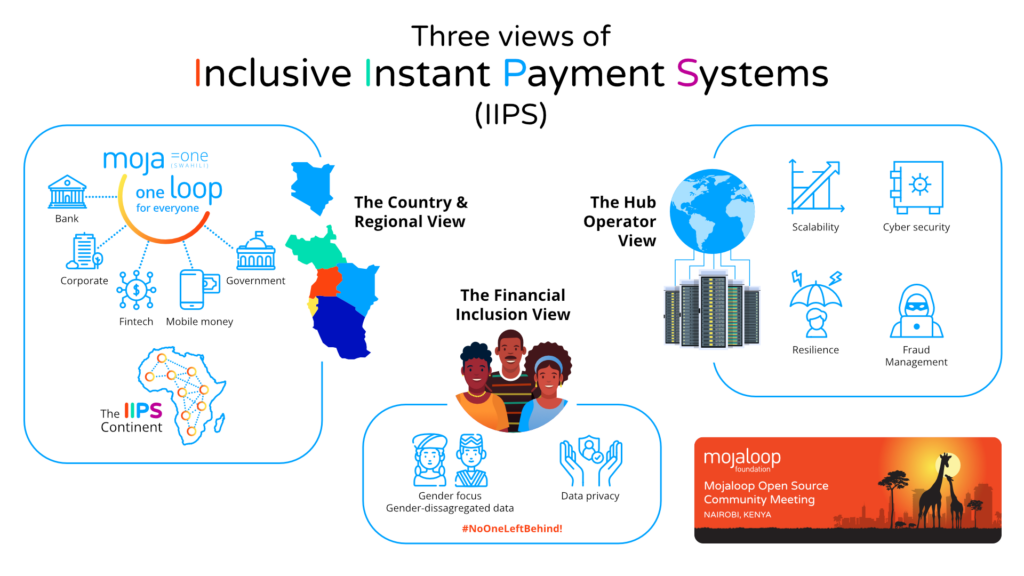

What I’d like to share with you is a summary of three important perspectives on IIPSs, which were all being explored and developed in presentations and discussions in Nairobi.

The Country/Regional View

In the diagram I refer to Africa as “the IIPS continent.” This is for two reasons.

The first is that Africa led the innovation of mobile money 12 years ago. Mobile money is a financial system that enables people who don’t have a bank account to transact through digital wallets that can be accessed via mobile phones. Today there are more than 230 mobile money systems across Africa.

Secondly, I think Africa is one of the continents where IIPS is happening right now, certainly in terms of the number of deployments, countries, and overall interest. As more countries in Africa have realized the benefits of instant inclusive payment systems, we see a lot of interest from others.

The Bill and Melinda Gates Foundation, with our partners like AfricaNenda, the Mojaloop Foundation and many others assist these countries to deploy IIPS systems. We want to help all 54 countries in Africa have their own IIPS, but we are far from that goal. Currently, to my knowledge, there are 18 countries that have an IIPS, but the count is increasing rapidly.

All of this is to say that today, it’s the domestic implementation of IIPS that is the focus.

As we go further, it will be important to consider the economic regions as well as the African countries. For example, there is the Western African Economic and Monetary Union, which includes eight countries that have the same currency in the same central bank, and they just went live with a regional level IIPS. There are also the Central African Economic and Monetary Community (CEMAC), SADC and the EAC regions.

As countries deploy IIPSs, the next natural step is to make these countries interconnect on a cross border basis so that eventually it will be possible to send money across borders in these regions and, ultimately, from anywhere in Africa to anywhere else in Africa instantly, very cheaply and in whatever currency. Building an IIPS for every country and then connecting them together will lead us to this vision.

That’s the other reason why I call Africa the IIPS continent: there is an interest in combining national IIPSs to achieve a regional or continent-wide.

The Hub Operator View

Hub operators are the ones who run IIPS infrastructure, managing everything from the technology to reinforcing the payment scheme rules to onboarding the financial service providers. Sometimes a hub is set up at the request of a central bank, but not always.

IIPSs are systems that run 24/7/365 and hence availability, scalability and resilience are all things that are on the minds of hub operators, according to the discussions that I heard in Nairobi.

Before joining the Gates Foundation, I worked for many years at SWIFT, the incarnation of resilience and availability, and it’s very important to see how hub operators in Africa are now stepping up to these new demands.

Availability simply means that people can use the system 24/7/365.

Resilience is a kind of a strange word, because people can take it to mean many things. When I say resilience, I mean the capacity of a system to sustain a failure and recover from it very fast.

This is because hub operators design their systems to be redundant. They have several operating centers, and in each operating center you have several units of processing, so that if one fails others can take over. If one side fails, the other side can take over, and so on and so forth.

And there are ways to design systems to be able to recover from failures. Mojaloop, in particular, as an open-source software, does implement a number of such features.

But whatever you do, you will face failure and it’s important that the downtime be measured hopefully in seconds or minutes, but certainly not hours.

The other characteristic of an IIPS, as you can imagine, is scalability. If you look at India, the UPI system has billions of transactions or tens of billions of transactions per month. I heard recently in Tanzania they were doing already a million a day with TIPS.

This notion of scalability is very important for reasons that are very easy to understand. First, you don’t want to provision a whole set of hardware and software that’s sitting there doing nothing, because you have foreseen that two years from now you will have enough volume. That unused hardware and software expenditure will directly contribute to increase your marginal cost.

What you want to do is to add capacity to the system as you go. As the traffic grows, you have this step function that follows the traffic. And so, each time the traffic grows beyond a certain point, you add another capacity unit, a computer or cloud or whatever.

The system has to be designed to do this right from the beginning — its architecture has to be what we call horizontally scalable.

Efficiency

Another important set of related topics being discussed at the convening was related to efficiency of processing. IIPSs have humongous volumes of transactions, but it’s still very important to process them efficiently.

When I spoke with hub operators, I was also pleased to hear how they measure that efficiency: by computing what is called the “marginal cost to process a payment” on their platform. In other words, they know what it costs them to process one transaction.

That is a very important measure because it allows them to do two things. First, it allows them to measure how they are doing because over time, hopefully that cost goes down. Secondly, this is an indication of what kind of price they will ask from the financial service providers as a fee to be part of the IIPS. Obviously, operators must cover their costs, so marginal cost is very key to their objectives.

I asked them, “How do you see Mojaloop, as an open-source software, influencing the marginal cost?” It was very interesting to hear how they thought that using an open-source technology can reduce the marginal cost by three times, some mentioned five times, and I even heard ten times.

Fraud and Cyber Security

The last big chunk of discussions was about fraud and cyber security, which are becoming a really hot topic in the payments space in Africa as digital platforms spread.

We’re not only talking about petty fraud from scams that harm individual people, but also systemic fraud such as money laundering and cyber security threats to the systems.

I was pleased to hear hub operators talking about “security by design.” I also had colleagues with me who worked on Tazama, the first open-source fraud management system, who were in high demand as the operators were very interested in providing a good fraud system.

The Financial Inclusion View

The third aspect in all of this is financial inclusion. While all these deployments of IIPSs are happening, we have to keep remembering why we are doing this to start with.

An IIPS is designed so that everyone can use it wherever they are and however poor or rich they are. When you dive into this notion, there are a couple of other characteristics that are very important, such as serving the most excluded within the excluded community, which in Africa are women.

It’s very important also to keep in mind that these systems need to achieve gender equality so that the women have the same opportunity as men and the systems must be designed in such a way to achieve this. The system must be architected to better serve women, and there are some rules and principles pertaining to that.

Notably, it’s important to measure how people are using it and the degree that women are using it and how that compare to men. Collecting gender disaggregated data in IIPSs is very important if we want to keep an eye on reducing the gender gap.

The Importance of “Instant” in Instant Payment Systems

So, what is an inclusive instant payment system? How do we define that?

We go by a set of principles that called Level One Project, which are documented on the Level One Project website. These are high level principles that do not mandate any implementation, but rather advise stakeholders which characteristics of a payment system make it more suitable to be inclusive and serve everyone.

The first set of principles say that if I send you money, you have it instantly and you can use it instantly for food, for school fees for your children, or anything you need. This becomes especially important if you don’t have other funds to use. And if you think about it, that mimics cash: if I give you cash, you take the cash, the transaction is done. Most instant payment systems are not inclusive because they don’t align with these instant and irrevocable principles.

There is another set of principles that relate to the interoperability of financial providers and who can be a financial provider in the system. We know that if we want financial inclusion to happen, banks alone will not do it simply because it’s not their mandate; they’re commercial companies, and it’s not their mission to include everyone in the country. They serve a particular client set for with a particular product set.

But if we want to include everyone in the country, then we must make a space for different financial service providers to come into play, and that’s how telcos come in with mobile money, banks come in with classical bank accounts, and FinTechs come in with various services and products. All this needs to interoperate to make a system that is fully inclusive, because then everyone in the country will have a financial service provider to choose from to access the system — as opposed to the situation before where if you don’t have a bank account, well, too bad, you’re excluded and there is no way around it.

When you have a variety of providers, if you don’t have a bank account you can have a wallet for mobile money and that allows you to participate as a person in the country’s economy.

The third set of principles relates to how the IIPS is governed. In an inclusive situation you don’t want the hub to start having some kind of profit incentive. If they do, then obviously at some point they will go to where the profit lies and not necessarily serve everyone.

Many hub operators that we encounter in IIPS setting tend to be operators that are owned partially by the central bank or have interest from central bank and hence they tend to operate on what we call a “not-for-loss” basis. Their goal is to make their operations sustainable and if they do make profits, it gets reinvested into the resilience, availability, and security of the platform. They tend to charge just enough to sustain their operation and be able to grow their system and as the scale demands.

To summarize — when a system provides instant and irrevocable transactions, ensures interoperability between all financial services providers and is operated on a “not for loss” basis, then it deserves the additional “I” in IIPS.