Over the past couple of years, we’ve seen some real momentum build around digital payment technologies and digital currencies. It’s a complex topic, and there are a lot of moving parts, but one factor that has had a major impact on this trend is the issue of cross-border digital payments. Historically, making payments across borders has presented significant challenges, and the desire to address these hurdles has helped contribute to the recent momentum we’ve seen in the space, as well as raised interest in regulation. Given this, an important place to start the conversation is to build an understanding of how payments are impacting – and being impacted by – upcoming regulations.

The Role of Regulations

Regulations are going to continue to play a major role in payment systems. Specifically, the G20 group of countries has established a work plan to address areas like cross-border payments, and to create a roadmap. Cross-border payments, of course, have always been an important part of the inclusion agenda, for example, to enable workers to send money home to their families. These are examples of the kinds of transactions that the G20 was particularly focused on being able to address.

Let’s take the example of payment hubs like Mojaloop, which will undoubtedly further evolve in the future. Right now, we’re focused on what it takes to implement basic interoperability. Over time, new use cases will demonstrate how to facilitate services for multiple currencies, or even the same currencies used cross-border, like within a monetary union such as those present in Africa.

These new use cases will be impacted by what’s happening with regulations and international standards for anti-money laundering. And, we can expect that open payment systems will be impacted by some of these future requirements.

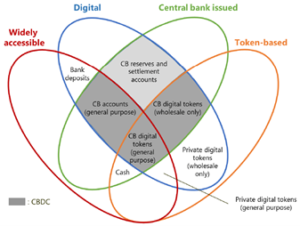

Future plans can get complicated, of course, with different types of digital payments for different requirements. This graphic shows where the central banks (CB) will introduce their own digital currencies (DC), alongside private digital tokens, cash and bank deposits.

Addressing the Cross-Border Challenge

The G20 recognizes that there are many challenges today for cross-border transactions related to costs, speed, limited access and insufficient transparency to the user. It wants to address the existing inherent frictions, while recognizing that financial innovation is creating opportunities that can bring greater efficiency and improvements to existing payment systems.

So, how do we foster the best possible conditions for providing cross-border payments? One key area is the desire to enhance interoperability – and this is where Mojaloop has an important role to play. This includes increasing the use of standard messages, format protocols and other mechanisms.

Mojaloop can have an extremely positive impact by reducing frictions in cross-border payments, in particular by addressing three key areas: fragmented and truncated data formats, legacy technology platforms and long transaction chains. More broadly, Mojaloop can improve direct access to payment systems, broaden the range of eligible candidates for the settlement accounts and pursue the interlinking of payment systems. As with any other payment organization, our long-term planning must be tied closely with policy initiatives and regulatory work. Things are changing quickly and good visibility of what’s coming up is critical to stay ahead of the curve. Learn more about Mojaloop’s work to make cross-border payments more inclusive.

For more on this, listen to my recent session on the topic. Join the Mojaloop community and learn more about how you can make an impact, and follow us on Twitter, LinkedIn and Facebook to keep up to date with the Foundation’s work.

For more information on how Mojaloop ties into the larger initiative of financial inclusion, read our One Loop blog series on topics, including Why Interoperable Payments Platforms Are Key to Financial Inclusion, Turning the Underserved into the Newly Served, Making Digital Financial Services More Affordable and Accessible, and How Digital Financial Services Benefit from Open Source.

About the Author:

David Mangini, General Manager, Giori Digital