Despite mobile money services emerging in nearly 100 countries, 1.7 billion people still lack access to digital financial services, according to the World Bank’s Global Findex. One big reason is the lack of interoperability between different services and transaction platforms, as well as complex governmental and regulatory requirements. Cooperation between governments and regulatory authorities is essential to establishing a safe and effective interoperable payments infrastructure.

Given the complexity of these challenges, companies have struggled to balance the cost of developing interoperable systems with the need to keep service fees affordable to the underserved. As a result, customers can transact only with other customers using the same service, while the unbanked need to transact across borders and service providers. Another issue is the prevalence of high-fee service options that are out of reach for many people in developing economies.

Mojaloop is different from other promising digital financial services and systems because it is an open source model that is available to any company at no cost, and it is designed to enable total interoperability.

In particular, Mojaloop:

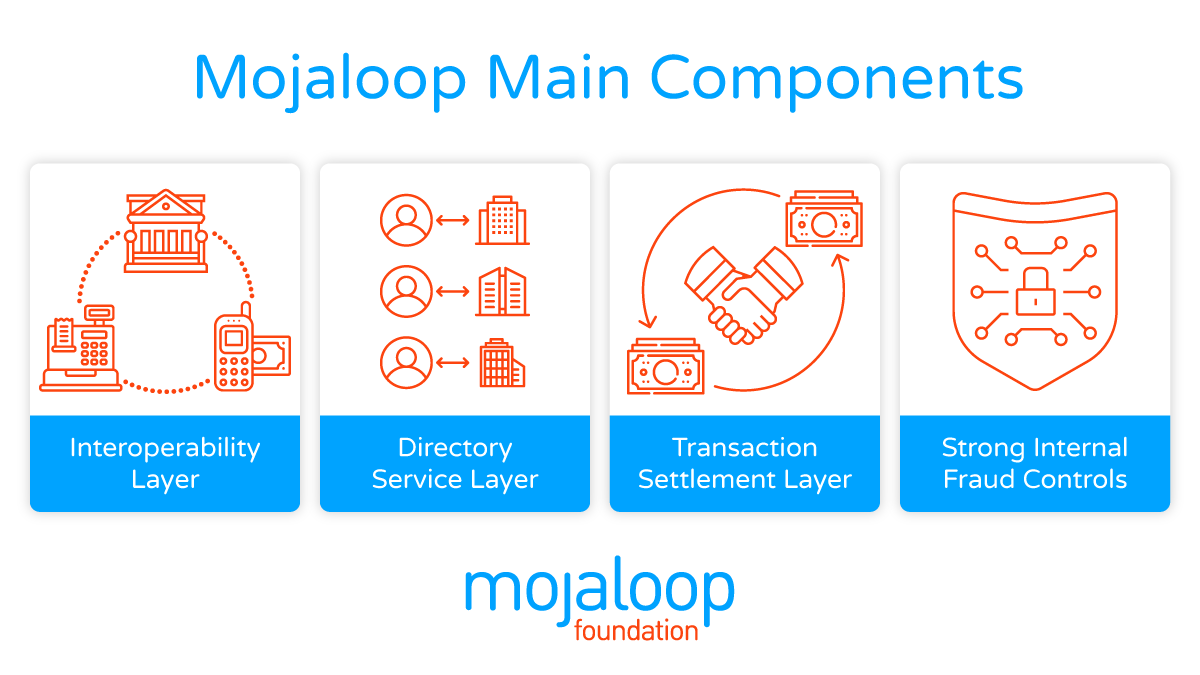

Enables interoperability through four components

- An interoperability layer connects bank accounts, mobile money wallets and merchants in an open loop.

- A directory service layer navigates the different methods that providers use to identify accounts on each side of a transaction.

- A transaction settlement layer makes payments instant and irrevocable.

- As well as components for designing and implementing strong internal fraud controls. Mojaloop was designed with the highest security systems in mind and already works with existing banking systems such as ACH (Automated Clearinghouse) and RT-RPS (Real Time/Real Payments systems). While these components strengthen the system, organizations are responsible for monitoring and protecting their payment models against fraud.

Uniquely Addresses Financial Inclusion

Mojaloop is designed with core Level One financial inclusion principles that outline how to build an inclusive, interoperable digital payments platform on a large scale. These principles stand alongside those drafted by the G20 and other international organizations committed to digital financial inclusion – including push payments and immediate funds transfer, same-day settlement and open-loop relationships between accredited participants.

Uses National Currencies

Mojaloop uses national currencies to ensure payments models increase financial inclusion and economic growth to the entire population in the same ways cash does. Mojaloop offers a blueprint for interconnecting financial services providers in a country or region-wide payments system and includes attribution of transactions to customers so that customer history can be built, and anti-money-laundering/fraud detection mechanisms can be run.

To learn more about interoperability and financial inclusion, read our One Loop blogs on topics such as Driving Financial Inclusion Through Interoperable Payments Platforms and Advancing Financial Inclusion through Interoperable Payments Models.

Mojaloop is reliant on its community of supporters, contributors, evangelists, developers, and others to make our work possible and help achieve the Foundation’s mission of providing universal financial inclusion to all. Learn more about how you can get involved in the community and make an impact.

About the Author

Paula Hunter, Executive Director, Mojaloop Foundation

Paula Hunter manages the day-to-day affairs of the Mojaloop Foundation with responsibility for strategic planning and direction, membership development, budgeting, evangelism for the Foundation and its mission, and outreach to strategic partners.